Crypto Wallet vs Exchange: Where Should You Keep Your Coins?

Many beginners who are just starting to invest in cryptocurrency spend most of their time thinking about which coin they should buy. Their main focus is on price changes so that they can easily make a

Many beginners who are just starting to invest in cryptocurrency spend most of their time thinking about which coin they should buy. Their main focus is on price changes so that they can easily make a quick profit.

However, thinking of making quick gains is their biggest mistake. Due to this focus, they take one crucial question for granted: Where should I store my coins?

Because the platform you choose to store your crypto on makes a big difference in whether your digital assets will be secured or if you might lose them forever.

There are many real-life incidents of exchange hacks and security failures which show that even the biggest and most popular exchanges can lose or freeze their users' funds. These are the important events that remind everyone that security is not just a joke that you can take for granted. If you are a crypto owner, you must understand that you are responsible for mitigating risks.

This blog will help you learn the difference between Crypto Wallets and Exchanges. You will also learn about the risks and advantages of both. By the end of this blog, you will know a simple rule to decide which storage option is best for you.

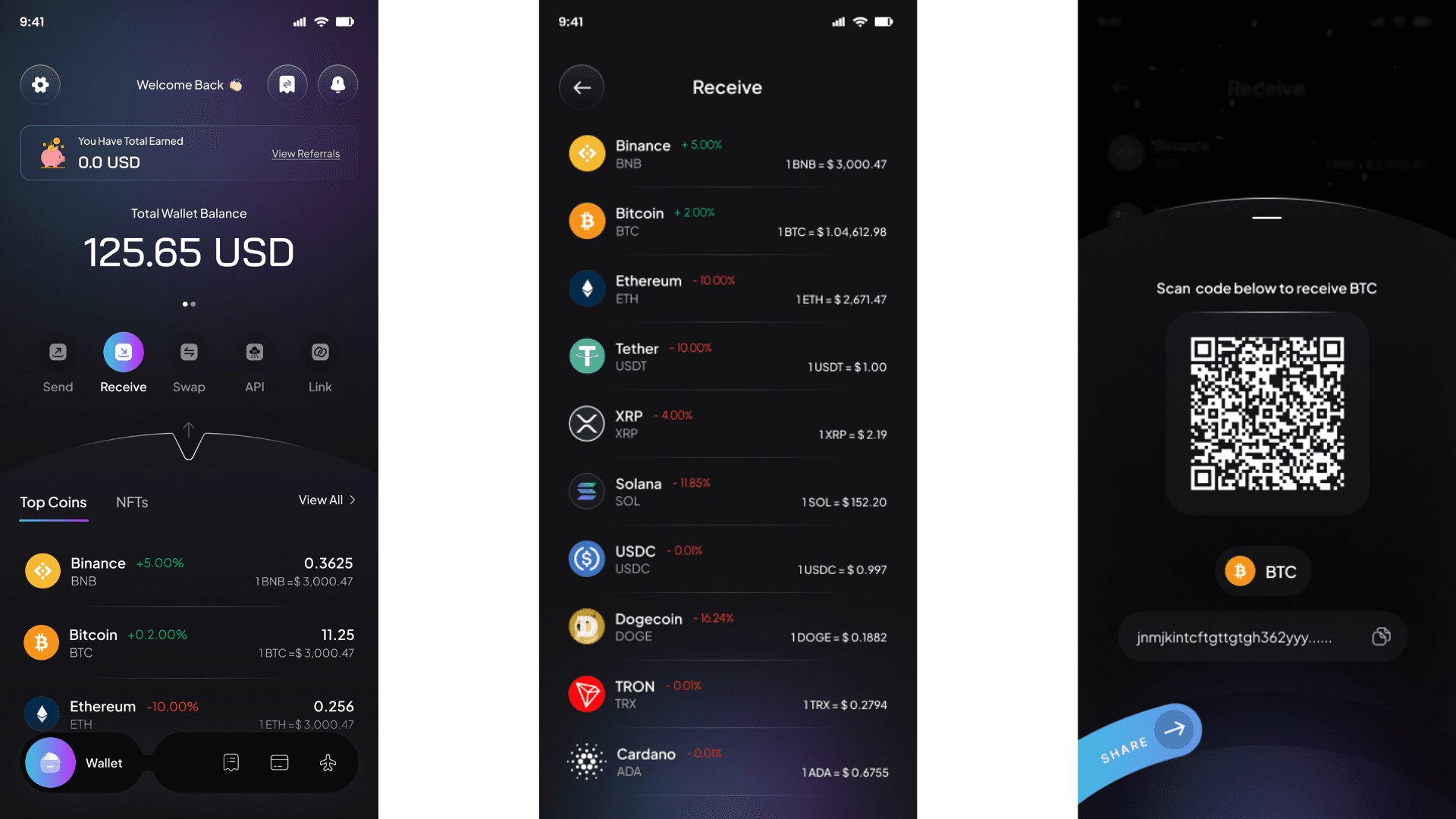

If you are looking for one of the best options in self-custody crypto wallets, then you should definitely give Oppi Wallet a chance. It provides advanced security, Buy, Sell, Swap, and Store options, and, most importantly, it helps you use your crypto in your daily life with its virtual card and travel features.

1. The Rule of Thumb

If you feel that it is not needed to read the whole blog to find the answer which one is best for you then here is the quick answer for you.

Exchanges are best for short-term trading and buying or selling your cryptocurrency quickly. In contrast, self-custodial wallets are the safest and best choice for long-term storage and fully controlling your digital assets.

While not common, some advanced self-custodial wallets now allow features like buying, selling, and swapping directly within the app, so users don't have to switch between multiple platforms.

For example, Oppi Wallet is a self-custodial wallet that allows you to manage your cryptocurrency with highly advanced security, ensuring stress-free storage. Beyond just storage, Oppi Wallet provides built-in Buy Crypto, Sell your Crypto, and Swap crypto with other crypto options. Most importantly, it bridges the gap to the real world with features like a Virtual Crypto Card and Travel Booking, allowing you to spend your crypto in daily life.

Because exchanges are convenient for trading and wallets are superior for security, many experienced traders follow a hybrid strategy. They keep a small amount on an exchange for trading purposes and store their main savings in a secure crypto wallet.

However, since modern wallets like Oppi Wallet now have built-in trading features, many experts are shifting entirely to self-custody wallets to avoid the hassle of moving funds back and forth.

But what if you are new to crypto? Starting immediately with a non-custodial wallet is easy, but it comes with the responsibility of keeping your device and keys safe. These are the habits that take time to build.

Therefore, a beginner can follow this strategy with a slight adjustment: Instead of keeping most funds in a self-custody wallet from the start, you should keep the majority on a trusted exchange and only a small amount in a non-custodial wallet.

Slowly, as you build these security habits, you can confidently move your funds from the exchange to your self-custody wallet.

2. What is a Self-Custody Crypto Wallet?

A self-custody or many people also say non-custodial wallet is a special tool for crypto users. This tool helps you to store and manage your cryptocurrencies safely.

But do remember that this type of wallet does not hold your coins directly. Instead it stores your secret information which is known as private keys. These private keys are the only way which allows you to control your crypto coins on the blockchain network, where a blockchain network is like a public record which keeps track of all your crypto transactions.

There are different types of crypto wallets:

Hardware Wallet: You can understand Hardware wallets as a device similar to USB Drivers. They keep your private keys stored offline which makes them very secure as no phishing or hacking attacks can be made.

Hardware Wallets are often called Cold Wallets because they are disconnected from the internet for most of the time.

The only disadvantage is that you have to keep this hardware wallet very secure at your place otherwise if it gets lost, damaged or stolen then you might temporarily lose access to your crypto. And if you have lost your seed phrase too then you have permanently lost your crypto

Mobile Wallet: Mobile wallets also known as software wallets and hot wallets are the apps which you can install on your mobile device. Mobile Wallets are very convenient for daily use, like buying, selling, swapping, and spending your crypto in real life.

Desktop Wallet: Desktop Wallets are also the same as they are also known as software wallets or hot wallets. To use this type of wallets you need to install their application on your computer, after that you can use them easily.

As mobile wallet is very convenient but with desktop wallet convenience is a bit lower as you will not be able to easily spend them in your daily life, still you can easily perform other features like buying, selling, swapping, managing

Browser Wallets: Browser Wallets run as browser extensions and they easily let you interact with blockchain websites directly. They are useful for decentralized finance (DeFi) and Web3 apps. But as they are browser wallets it needs more careful protection.

Now what makes a self-custody wallet simple is that you are the one and only who holds and controls your private keys. This means that no other company or exchange or anyone else has access to your funds.

In self-custody wallets we can say that you are your own bank and the only person who can buy, sell, and have access to your funds. If you ever lose your private keys or recovery phrase (seed phrase), then your cryptocoins could be lost forever, so self-custody requires responsibility. To learn more about how self-custody works and why it matters, read our complete beginner's guide to self-custody wallets

3. What is a Crypto Exchange?

A Crypto Exchange is a platform on which people can buy, sell and swap your cryptocurrencies. There are mainly two types of crypto exchanges, one is centralized exchange (CEX) and the other is de-centralized exchange (DEX)

Overall we can say that upto 70-75% Crypto Exchanges are centralized or CEX and the other 25%-30% is De-Centralized Exchange or DEX.

A Centralized Crypto Exchange is a platform which a company has created and they run that platform acting as the middlemen between buyers and sellers.

But there are advantages also to use CEXs as they offer many features, like easy ways to trade crypto and fiat, advanced tools for trading and they have high liquidity. Here high liquidity means that there are many buyers and sellers available so you can buy or sell your crypto quickly without big price changes.

A centralized exchange holds your crypto on behalf of you so you don't have full control over your coins. This simply means that if the exchange wants to hold your crypto then they can, or else if the exchange gets hacked or goes bankrupt then also you will lose access to your crypto. Also many exchanges require stick rules, like it requires you to complete identity checks (KYC) to comply with laws. This helps to prevent frauds but it also means your privacy is limited

There are also Decentralized Exchanges or DEXs. These exchanges are not operated by a central company in charge like centralized exchanges. Instead you can say this as a direct marketplace where you can buy, sell and trade your crypto with other users through an automated computed program which is known as smart contract.

In DEX there are no middlemen controlling your assets. You can connect your own crypto wallet directly to the marketplace. By this you can say that your funds are always in your control which offers more privacy and security.

Though DEXs gives more control and privacy to its users but it may have less liquidity and is harder to use for beginners

Overall we can say that centralized exchanges are best for quick trading, buying and selling crypto instantly and for using advanced trading tools. Whereas, Decentralized Exchanges are better for those who want privacy and direct control but they have to handle some complexity with these benefits.

In this guide, further we will see a comparison between exchanges and wallets, because we get many requests for this to choose an exchange or wallet. Obviously we suggest Oppi Wallet.

4. Wallet vs Exchange: Head-to-Head Comparison

Here is the head to head comparison between Wallets and Exchanges which will help you understand the key differences between wallets and exchanges. Each option has its own strengths and risks, so the best choice always depends on what you value most: Control, Convenience, or a mix of both.

|

Feature |

Crypto Wallet |

Crypto Exchange |

|

Who Controls the Keys |

You are the only one who holds your private keys and controls your funds directly. |

The exchange holds your keys and manages your funds for you. |

|

Security Model |

Self-custody means that no third party can access your crypto unless you share your keys or someone stole your keys. More secure but requires responsibility. |

Custodial model means you rely on the exchange’s security. So there is always the risk of hacks, account freezes, or regulatory actions which can affect your funds. |

|

Convenience |

Great for everyday payments, DeFi, NFTs, and controlling your crypto. You manage all transactions on the blockchain. (some wallets also offers options for buy, sell, swap just like exchanges) |

Best for active trading, quick buying/selling, and converting between fiat and crypto with built-in tools and liquidity. |

|

Fees |

Pay blockchain network fees and any wallet service fees (like card usage). No trading fees. |

Trading fees, withdrawal fees, and sometimes deposit fees apply. Prices may include slippage or spread. |

|

KYC and Privacy |

Minimal personal information needed for pure self-custody wallets. More privacy and control. |

Exchanges require full KYC/AML verification, limiting privacy but following regulations. |

|

Regulation & Recourse |

No regulation or insurance. If you lose keys or make a mistake, no one can help recover funds. |

Regulated exchanges offer some degree of consumer protection and customer service support but can also freeze or seize accounts under some conditions. |

Nothing is perfect in this world and that applies to exchanges and wallets also. Wallets will give you full control and security but they require your carefulness also. Whereas exchanges make trading easy and offer high liquidity but they come with custodial risks and regulatory oversight. So choosing between these wallets and exchanging them is the same as choosing between your two favorite things.

So we suggest that you should select a crypto wallet which offers advanced security with features like buy, sell, swap. There might not be as high liquidity as a centralized exchange but this type of wallet will save your time and it will save you from switching between two apps every time.

Here Oppi Wallet is the best fit for everyone as it provides advanced security with buy, sell and swap features. It also provides useful real world features with which you can easily spend your crypto in real worlds. You can read Oppi Wallet Getting Started Guide to easily start your crypto journey with Oppi Wallet

5. When an Exchange Actually Makes Sense

Many crypto guides say “Don’t keep your funds on exchanges” but that advice is not as straightforward as it seems.

Because the truth is that the exchanges also have some important perks which can be utilized properly in some certain situations. But understanding this situations helps you make smarted decisions

Exchanges are good in situations like:

Active Trading: Active trading means that if you trading your crypto, buying or selling them actively like several times in a day or a week.

If you are doing active trading then exchanges are the best tool for you because they let you make trades really fast. You can also use their advanced tools like limit orders and stop losses which helps you manage your trade better. Also you get to dive into derivatives and futures market. Plus their is much higher liquidity on an exchange so your transactions are instant and you don't have to wait for a buyer or seller.

Buying Crypto with Fiat: Buying crypto with your regular cash (like dollars or euros or rupees) is pretty straightforward on an exchange. Also exchanges have high liquidity, so you can buy or sell quickly without big price changes

Short-term storage: After buying crypto from an exchange you can use it as a short-term storage to keep short amount of your cryptos but make sure it is a temporary place. Once you think the right time has come so you can transfer your funds to your self-custody wallet

Access to specific tokens easily: Cryptocurrencies which are recently launched or are not that big are not available on all wallets or if they are built on established blockchains then the wallet may support them but you have find them manually by adding their contract address.

So if you want to buy them then you can use exchanges where you can find them easily though big centralized exchanges may take some time but you can easily find them on any de-centralized exchanges.

Important risks to understand:

Even though exchanges are convenient as they have higher liquidity, this advantage of exchanges comes with real dangers.

As there are many users using exchanges so there is a higher pool of money. And this thing makes exchanges an attractive target for hackers.

Many large scale hacks have happened many times in the history of crypto on exchanges, which resulted in billions of dollars lost.

Since you don't actually own your private keys, this means that your funds are being controlled by another person and not you and in this case the third person is the exchanges. So whenever exchanges want they can hit the pause button on your withdrawals.

Now the reason behind this may be some rules from regulators, or they are facing some issues, or when they are facing high time demands.

Plus these exchanges requires strict identity check (KYC), which basically means that they are keeping an eye on what you are doing financially and that is why your privacy is also being limited

The smart approach is that you should use exchanges for what they are doing best. Like instant trading and converting fiat to crypto but never treat your exchange like any other crypto wallet.

You have to keep that amount only which you need for trade and move the rest of the amount to a highly advanced and secured self-custody wallet like Oppi Wallet so you can store your digital assets for long term easily and that too without the headache of wallet being hacked.

6. When a self‑custody wallet is the better choice

Now lets talk about self-custody wallet which are the other side of a coin. So each crypto guide and experts agree on one thing that whenever it comes to storing meaningful amounts of cryptocurrency for long time then the best and most secure way is to store them in a self-custody crypto wallet.

The best setup for securing your crypto is using a hardware wallet for big savings with a good self-custody software wallet with advanced features like Oppi Wallet for your daily use and real-time spending.

This combination gives you both maximum security and real-world convenience. Hardware wallet (cold wallets) are also self-custody wallets and they are not connected to the internet so your assets are safe from hackers, scams and phishing attacks.

Plus a software wallet (hot wallet) which you are using is also a self-custody wallet and that too with advanced features. We would suggest Oppi Wallet as it is also self-custody, comes with high security and features like buy crypto, sell your crypto, swap your crypto, spend your crypto using virtual crypto card and travel card.

Self-custody wallets work best in these situations:

Long-term holding (HODL): If you are buying cryptocurrency with the intention of holding it for a long time like a month or year then a self-custody wallet is the only thing which you can trust on. Because when you are holding your crypto then you don't need trading tools which every exchange provides.

Also keeping large amounts on an exchange is like giving your bank account password to a third-party company. You trust them to hold your money, but you risk losing everything if they get hacked or go out of business.

Whereas, in self-custody wallet you own your private keys so if that company gets hacked or goes bankrupt and shutdown then also your crypto will always remain with you and under your control.

When you value control over convenience: If you are a type of person who prefers to have full control on their finances and don't want any third person to have access to your funds then a self-custody wallet is made for you only.

Because when you trust and keep your assets on an exchange you are not keeping them for their security features instead you are prioritizing the convenience. Convenience of high liquidity.

But focusing on this benefit you ignore the most important thing which is your private keys. Because if you don’t have access to your private keys then it is simple to say that your assets are controlled by a third person in your case that is exchange, and whenever they get hacks or goes bankrupt you will lose each and everything

Whereas, people who were valuing full control over the convenience are in full control as they own their private keys and whether the company get hacked or goes bankrupt then also no one is able to touch your assets rather than you.

But with full control there comes the responsibility of security as you have to stay safe from clicking on phishing links, secure your device from getting hacked and also secure your seed phrase.

Everyday payments and real-world spending: This is the main benefit where many self-custody wallets fall short but not all of them. Now the problem is that if you want to use your crypto like spend them on buying things or paying bills or book travel. So to do all of this stuff you will need to transfer your crypto from wallet to asset again.

Because many self-custody wallets only allow send and receive crypto options so you can not do anything in that. You can just store, send and receive your crypto. But now with wallets like Oppi Wallet have solve this problem completely as you can easily spend your crypto in your day to day life just like real cash

DeFi, NFTs, and Web3 activities: If you want to explore decentralized finance (DeFi), buy or collect NFTs, or use Web3 applications then you must have a self-custody wallet. Because these activities require direct blockchain access that any exchanges simply cannot provide.

Your self-custody crypto wallet connects directly to DeFi protocols, NFT marketplaces, and decentralized apps giving you full freedom to participate in the crypto ecosystem.

So now what makes Oppi Wallet stands out from other Wallets is that it offers all security features of self-custody which means you own your private keys and no other person has access to it so your funds are also completely secured. But this is not just what Oppi Wallet offers. It goes a step further with real world usefulness of your crypto which many wallets just don't have

With Oppi Wallet you can easily manage Bitcoin, Ethereum and over 40+ other cryptocurrencies all in one place.

But the cool thing is that you can actually spend your crypto without going back to an exchange. You can create your virtual card or order a physical card right in the app and use it to pay anywhere Master Card or VISA is accepted as your crypto will convert to regular money automatically when you make the payment.

Also another cool feature is that you can directly use Oppi Wallet to book flights and hotels with your cryptocurrency and this is best feature for those who want to use their digital assets in the real world.

And if you run a business then Oppi Wallet also provides API so business can also spend in crypto and provide virtual card to their employees and book tickets using crypto easily.

This means you are not forced to choose between security and usability. As you get both. You can store your crypto easily and safely in self-custody and still spend it for everyday things, travel, and business without having to transfer everything back to an exchange first.

If you want to learn more about how to spend crypto worldwide with Oppi Wallet's virtual card feature visit our virtual crypto card page. And if you are a business owner interested in receiving crypto payments securely check out their business API features.

7. Hybrid Strategy: What Most Advanced Users Actually Do

Here is the hidden trick that most experienced crypto users follow and this is something that beginners think about but are afraid to use.

No one is actually forcing you to select only one option between exchange and wallets. Because when you choose only one option you will feel stuck. If you choose exchanges then you will get high liquidity and other advanced trading tools but your funds are not in your control.

And if you choose wallets then you will have advanced security, other features and most importantly your private keys are with you but to stay honest with you we should let you know that you will not get that much high liquidity like exchanges.

So there are pros and cons of both and that is why the smartest approach is to use both together in such a way that it gives you maximum benefits with minimum risks

This hybrid strategy is simple and practical. Here is how it works:

Keep only funds that are required for trading on exchanges. And if you are actively trading then math down properly that how much crypto is enough for trading for the week or month. And first start with keeping the amount for a week and then move ahead.

And once you are done then move your profits or the left over assets instantly to your self-custody crypto wallet. With this strategy you get to take benefit of high liquidity trading, advanced trading features of exchanges and advanced level of security and other features of self custody wallet.

Remember to always move your extra savings or profits instantly to self-custody. You can think this as a rule of thumb that you should not keep your money in an exchange account because this is like carrying huge amount of cash in your physical wallet on a busy street where there is always risk of getting robbed.

And instead of carrying that cash in your wallet if you have kept them in a secret vault at your place then your money is still safe just like self-custody wallet which keeps your crypto secured always because you are in charge of your money.

And now this was all about small amounts, but what if you have large amount of crypto so now you can add the third option with this two which is hardware wallet or you can say cold wallets. Store most of crypto in hardware wallets. Keep some amount in software wallets which you can use in your daily and keep small amount for trading on exchanges.

Or else instead of the three-way model you can also use a two way model in which use hardware wallets to store most of your crypto and use a software wallet with high security and advanced features so you can easily perform all the actions like exchanges. But do remember that you will not get that much amount of liquidity here which you were getting on exchanges so trade smartly.

Think of it this way. Exchanges are like big busy markets where you go to buy, sell and trade quickly but their is always risk of getting robbed.

Whereas Software wallets are like small shop vendors where you will not get that much amount of buyers, sellers and traders. But you have full security as you can keep eye on each and everything as you are the boss.

And atlast think of hardware wallets like your personal vault or safe. Where you can easily store your crypto but you can not buy, sell or trade. So create a proper hybrid strategy and then only start with crypto.

Here is a simple flow that most advanced users follow:

Your Money Flow:

-

Step 1: Fiat money (dollars, euros, rupees) → Exchange (for active trading with advanced tools)

-

Step 2: Exchange → Oppi Wallet (move your profits and savings to your self-custody (we are taking example of Oppi Wallet))

-

Step 3: Oppi Wallet → Buy, sell, swap when needed but not that much high liquidity like on exchanges OR spend with virtual card, book travel, use for business, or hold safely

For Very Large Amounts:

Hardware wallet (vault storage for your biggest holdings) + Oppi Wallet (daily access, spending, travel, and business features)

This hybrid approach gives you the best of everything. You get trading speed when you need it, full control and security for your savings, and real-world spending power through Oppi Wallet's card and travel features. No compromises needed.

8. How to Move Your Coins from an Exchange to a Wallet Safely

Moving your crypto from an exchange to your self custody wallet is not hard but you need to be very careful while doing this. Because one small mistake with the address and your crypto could be gone forever. So let's break this down into easy to understand steps that anyone can follow.

Note: Each wallet has almost same steps for moving coins from an exchange to wallet

Step 1: Get Your Oppi Wallet Address

Open your Oppi Wallet app and on the dashboard you will find the “receive” button. Clicking on the receive button a page will open where you need to select which cryptocurrency you want to receive. And this is very important because each crypto has a different address like bitcoin has a different address than ethereum. So make sure you select the right blockchain network. Once done. Then copy your wallet address by tapping the copy button or you can scan the code too.

Step 2: Start the Withdrawal on Your Exchange

Now login to your exchange account and go to the withdrawal or send section. Now with full attention select the same cryptocurrency that you have previously choose in Oppi Wallet or we can also say in your preferred wallet. Now here is the most important part as you have to properly paste your Oppi Wallet address into the recipient field do not type it manually as if anyof the character is missing by mistake then it will go to another address.

Do double-check the first 5 characters and last 5 characters of the address to make sure the address match exactly because some malwares change the address once you copy past or write down manually in the withdrawal field.

Step 3: Send a Test Transaction First

Instead of sending full amount at once you can do a smart move by sending a small amount at first. Wait for the amount to arrive in your Oppi Wallet account which usually takes a few minutes to hour which totally depends on your blockchain and crypto. Once you receive that amount safely in your wallet you know the address is correct.

Step 4: Transfer the Rest

Now that you have confirmed everything is working well be sending small test amount. You can send large amounts as well. For that go back to your wallet select your crypto from the list which you want to receive. Your receive code will appear. Copy that and send your full amount but do a double check then also.

Important Safety Tip

Before moving any large amount of crypto in your Oppi Wallet account or any other self custody wallet do cross check that you have properly keep your recovery phrase (seed phrase) at a safe place at your home which only you can access.

If you have not noted down your recovery phrase on a paper and kept it online then we would suggest that at first place note down your seed phrase on a paper and keep it on a place which only you can access and not any other person.

You should never keep your seed phrase stored digitally, as this makes your assets highly vulnerable. If you click a phishing link or if your phone, laptop, or computer is hacked, the digital copy will instantly give the hacker access to your entire wallet.

And always keep your seed phrase in such a place which is highly-secured, only accessible by you and most importantly you remember that you have kept your seed phrase at this place. If ever you lost your seed phrase then you not only lose that paper but you have also lost your access to your crypto.

If you need more help with getting started check out the Oppi Wallet FAQ center for detailed guides. And if you run into any issues the Oppi Wallet support page is always there to help you.

9. Checklist: Where You Should Keep Your Coins

Now let's make this whole guide super practical. Answer these three simple questions honestly and you will know exactly where to keep your crypto.

Question 1: Do you trade multiple times a day or mainly buy and hold?

If you are frequently buying crypto and selling several times in a week or month then definitely you need to use exchanges because you will get benefit of high liquidity.

But if you buy crypto and then store it for longer periods then exchanges are not considerable for you as you will need high security to protect your assets. So in this case you can use a self-custody crypto wallet in which you will only own your private keys and you will get advanced security features.

Question 2: Are you comfortable writing down and storing a recovery phrase safely?

Whenever you start using any self-custody wallet they will give you a recovery phrase which is also known as seed phrase. You have to keep this safe because if you lose this then you also lose your crypto and no one will be able to access or recover your funds without a recovery phrase.

So if you are ready to take this responsibility then self-custody is for you and if you think this is a hard task then first start with small and try to take this responsibility. In near future if you think that yes you can do this then start transferring more funds in self-custody wallet.

Question 3: Is your total crypto amount closer to "beer money" or "house money"?

Be honest here. Is your crypto portfolio worth less than a nice dinner out? We would suggest you keep it simply on an exchange for now. But if we are talking about serious money like thousands of dollars or your savings then obviously you need a proper security and their is nothing better than self-custody

Your Profile: Where Should You Keep Your Crypto?

Based on your answers here is what makes sense for you:

Profile 1: Mostly Trader

If you trade regularly then keep the amount you need for actively trading on a reputable exchange. But never keep 100% of your crypto there. Move your profits or any other savings which you think will not be required in trading amount immediately to a self-custody crypto wallet like Oppi Wallet. This way you get both high-liquidity while trading and control and security for your assets.

Profile 2: Mostly Holder (Long-term Investor)

If you are a long term investor and rarely trade then it is not necessary to keep your amount on exchanges but then also we would suggest to keep a very small amount on exchanges maybe enough to sell quickly.

And put all in a self custody crypto wallet. And if you have a very large amount of assets then we would consider getting a hardware wallet and add 70-80% of your holdings there and rest in Oppi Wallet. So whenever you need to use them, swap them or do any other thing you easily do.

Profile 3: Mixed User (Holder + Spender)

If you hold crypto for long-term but also you want to spend your crypto in real life then keep a very small amount on any reputed exchange to buy and sell occasionally. Now either put your rest of all cryptos in Oppi Wallet which will secure your crypto also and give you power to spend them in real life also.

Or else you can divide your crypto and keep half the amount in hardware wallet and the other half in Oppi Wallet which you need to spend.

No matter which profile suits you better, here the key lesson is the same. Never put all your eggs in one basket. Utilize each and every platform properly. For quick trading and liquidity use exchanges. And use self custody wallets for security and full control.

10. Frequently Asked Questions

Q. Is it safe to leave crypto on an exchange?

Ans. For small which you need for daily trading we would say yes, but never for a large or long term holdings. You can think of exchanges like carrying a little cash when you go shopping. Where a small amount is fine but you would not go shopping with your entire life savings in your pocket.

The same logic applies to exchanges. Because exchanges can also get hacked, face some legal issues or even freeze your withdrawals. Then what would you do. So only keep the amount which is required for trading and move everything else to self-custody wallet where you control everything

Q. Can a wallet be hacked?

Ans. Yes, even wallets can be hacked but it is much harder than exchanges. Self custody wallets are more secure because the keys are not stored on their server instead it is stored in your device. So hacking their server will not be beneficial for hackers but you have to be aware from phishing links.

Where they ask to enter your recovery phrase (seed phrase). Or even they will add some malware so whenever you will access your wallet that malware can also share access to the hacker or they would change your wallet address with theirs. Also some malware can access your images and docs to check your seed phrase.

And that is why we suggest our users to store their seed phrase in a paper and keep that in a very secure place which only they can access and also not rely on 1 copy create multiple copies of this. Because good security habits make hacking your wallet extremely difficult.

Q. Can Oppi Wallet freeze my funds?

Ans. No because oppiwallet is a self-custody wallet or you can also say this as on chain or non custodial wallets and in this type of wallets you control your private keys and they are stored on your device which means that no Oppi wallet, no any other self-custody crypto wallet, no government, no any other person can access your wallet or freeze your wallet. And this is the biggest advantage of self-custody crypto wallet.

But this also means that their is no “forgot password” button, so if you lose your recovery phrase (seed phrase) then nobody including Oppi wallet can help you recover your crypto.

And that is why it is important to write down your recovery phrase on paper and store it somewhere very safe and have multiple copies of this. So if ever one copy gets destroy somehow. Then you have the backup of your phrase key. Using self custody wallet you have to become more responsible because with great power comes great responsibility.

Q. What happens if I send crypto to the wrong address?

Ans. Unfortunately you cannot reverse your crypto transactions if you send it to the wrong address. That is why we suggest to send a test transaction first before moving larger amounts.

This small step can save you from sending crypto to wrong address. Also do double check your first and last 5 digits each and every time before moving because many hackers add malware in which you will enter your address correctly but it will automatically change to hackers address. So do double check your address properly each time.

Q. Do I need to pay taxes on crypto in my wallet?

Ans. Tax laws vary by country. In most countries simply holding crypto in your wallet is not taxable but buying, selling, swapping or spending usually is taxable. Therefore it is suggest to keep records of all your transaction and consult with a tax professional in your country to understand your specific obligations.

11. Conclusion

So now you know the real answer to the question which every beginner asks: Where should I keep my coins? The answer is simple but it depends on what you value most and how you plan to use your crypto.

If you are an active trader who buys and sells multiple times a week then exchanges make sense for that trading amount. But never keep all your crypto there because exchanges can get hacked, freeze withdrawals, or face legal problems that put your funds at risk.

For long-term storage and meaningful amounts, self-custody wallets are the clear winner. You control your private keys, your funds are safe from exchange failures, and you get the peace of mind that comes with true ownership.

But here is the best part. You don't have to choose just one option. The smartest crypto users follow a hybrid strategy where they use exchanges for quick trading and self-custody wallets like Oppi Wallet for secure storage, daily spending, and real-world use.

Oppi Wallet stands out because it gives you the security of self-custody plus features that most wallets don't have. You can buy, sell, and swap crypto without going to an exchange. You can spend your crypto using a virtual card. You can book flights and hotels. And if you run a business, you can accept crypto payments easily.

Remember the golden rule: Never put all your eggs in one basket. Use exchanges for what they do best which is trading. Use self-custody wallets for what they do best which is security, control, and real-world utility.

Your crypto journey starts with making smart storage decisions. Choose wisely, stay safe, and take control of your digital assets today with Oppi Wallet. Download Oppi Wallet now from Play Store or App Store